Green Backed

Why the dollar still dominates, and why that matters

By Mark Copelovitch

For over fifty years, since Richard Nixon closed the gold window and ushered in the end of the postwar Bretton Woods international monetary system, a regular chorus of politicians, policymakers, scholars, and journalists has predicted the imminent end of American hegemony. From the Soviet Union to Japan to China, each decade has brought a new geopolitical challenger and economic superpower to rival or replace the United States. The decline of American power, we are told time and again, heralds the end of the dollar’s role as the world’s dominant international currency.

More recently, in the wake of the pandemic-induced economic crisis and the Russia–Ukraine war, the dollar’s demise again captured the Zeitgeist. Nearly every month, a global smattering of articles and opinion pieces highlights the supposedly imminent passing of the dollar’s preeminent status. Some argue that US-led financial sanctions on Russia will accelerate the dollar’s downfall, as Russia, China, and other countries seek to shift into other currencies to escape America’s economic and geopolitical coercion. And since the spring 2023 debt-ceiling histrionics, the drumbeat of predictions about the end of the dollar’s “exorbitant privilege” has grown even louder, often accompanied by hyperbolic claims that the US may soon be unable to borrow or service its sovereign debts, or risks the onset of hyperinflation. The chorus of dollar skeptics has grown so loud that it is now a matter of conventional wisdom that the end of dollar hegemony is only a matter of time.

Yet despite this dominant narrative of demise, the dollar remains the unchallenged king of the international monetary system. Certainly, the US has its share of economic and political problems, and other currencies such as China’s renminbi (RMB) are beginning to slowly play a larger role in global finance. Yet dollar hegemony rests on far deeper and more durable foundations than the skeptics realize, for reasons including the sheer enormity of the US economy, historical inertia, and the deeply embedded hierarchical network structure of international finance.

International reserve currencies

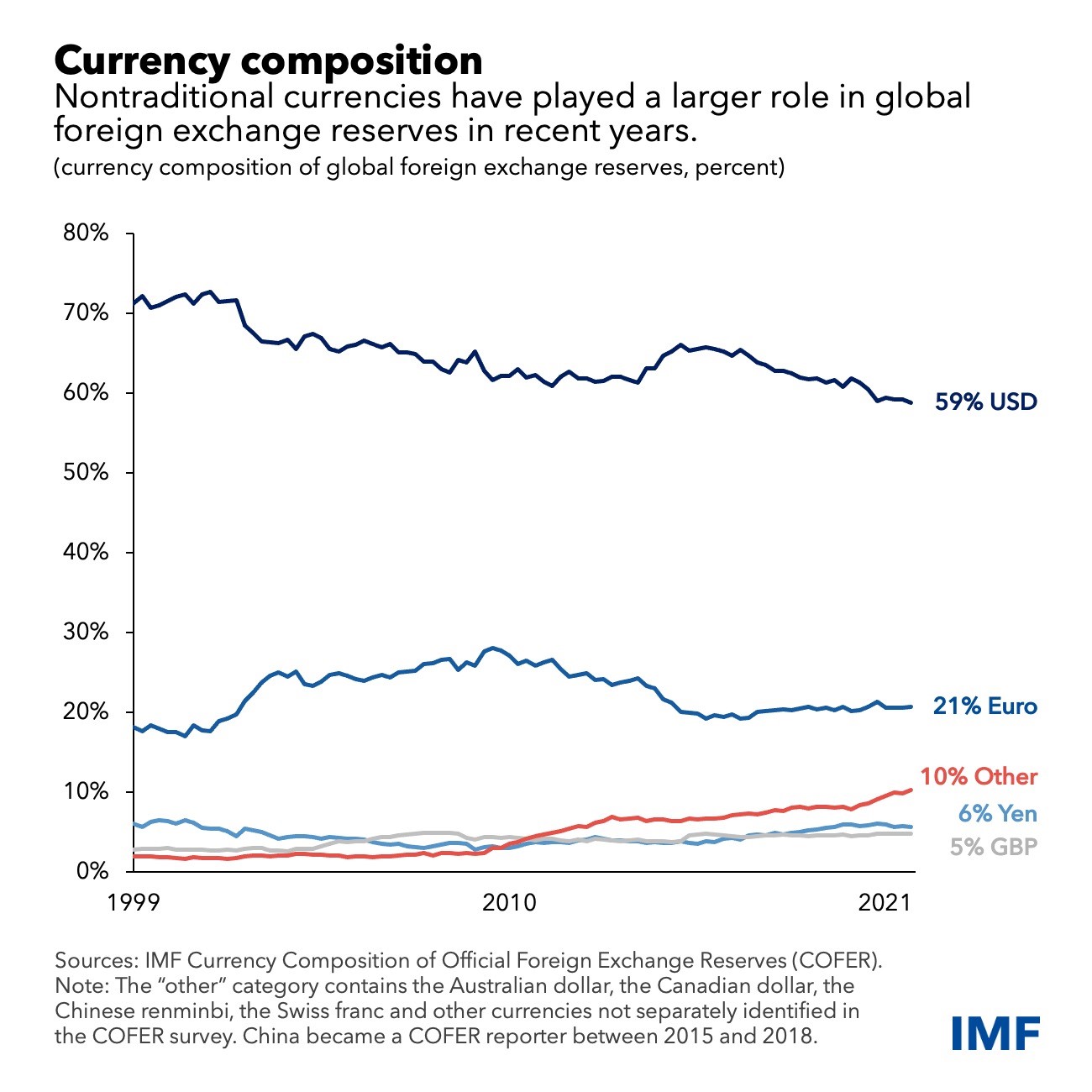

To understand why dollar hegemony is not under threat, it’s important to fully grasp what it means to be the world’s primary reserve currency. Reserve currencies are those held widely by governments, central banks, and private institutions to conduct international trade and financial transactions. The dollar shares this distinction with only a few other major currencies, including the euro, Japanese yen, Swiss franc, British pound, Canadian and Australian dollars, and the RMB. The most common metric for measuring which currencies are global reserve currencies is to look at those the world’s central banks hold as foreign exchange (FX) reserves— the measure most frequently cited as evidence of the dollar’s decline. Figure 1 shows the US share of FX reserves declining from ~70 percent in 1999 to below 60 percent now. This sounds drastic and has sparked much consternation in the international media about the dollar’s accelerating demise. Look deeper, however, and one sees two problems with this interpretation.

FIGURE 1

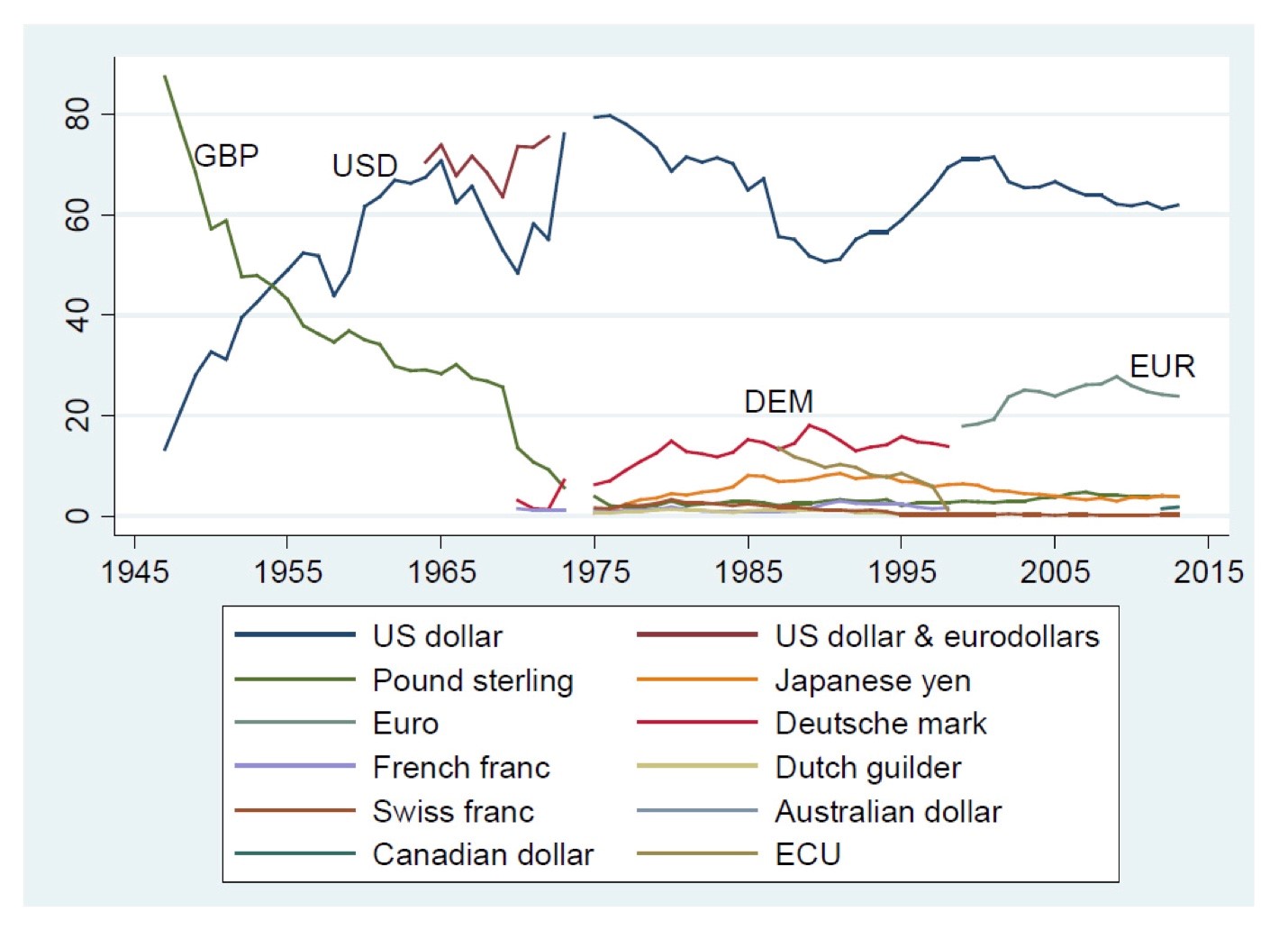

First, if you zoom out and look at longer-term historical trends (Figure 2, below), it becomes clear that the 1999 level was an outlier, largely reflecting uncertainty about the stability of the euro at its founding (amid concerns, particularly in Germany, about whether the euro would be as stable as Deutsche Mark and able to replace it as the number two global reserve currency), as well as the rush to the safety of US Treasury bonds during the Asian financial crisis of 1997–99. Indeed, when one looks back further, to World War II, one sees that the dollar’s share has fluctuated somewhat since the 1950s, but that the current level of dollar dominance in FX reserves is exactly the same as it was in the late 1950s and actually higher than it was in the late 1980s and early 1990s. Second, the dollar’s “loss” in FX reserve shares since 1999 has not been the “gain” of any single other currency. Instead, what we see is that the modest and slow decline of dollar reserves mostly reflects the diversification of central bank holdings into a broader set of “other” currencies—the yen, Swiss franc, Canadian and Australian dollars, and, yes, the RMB—rather than a zero-sum shift from dollars into a single rising challenger currency. This is evidence of many things, including the deeper integration of a broader set of countries (including China) into the global economy since the 1990s. But it is by no means, on its own, evidence of the dollar’s loss of its dominant position in the reserve-currency league table.

FIGURE 2

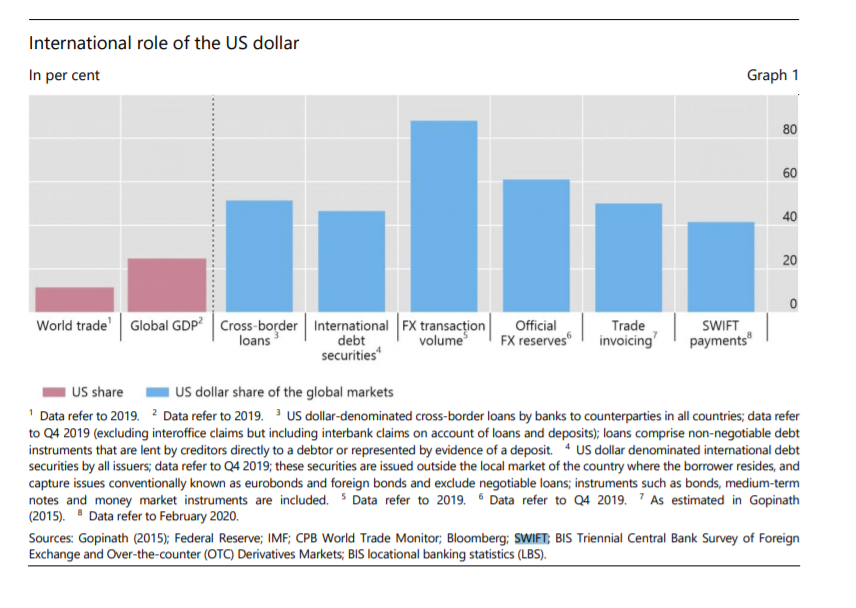

More importantly, FX reserves are only one dimension of reserve currency status. As Figure 3 illustrates, reserve currencies are also the ones used in private international financial transactions (such as cross-border loans, foreign-exchange trading, and interbank transfers); they are also the currencies in which the central activities of globalization—international finance and trade—are denominated. On every one of these dimensions, the dollar is either overwhelmingly dominant or shares dominance in tandem with only one other currency: the euro.

FIGURE 3

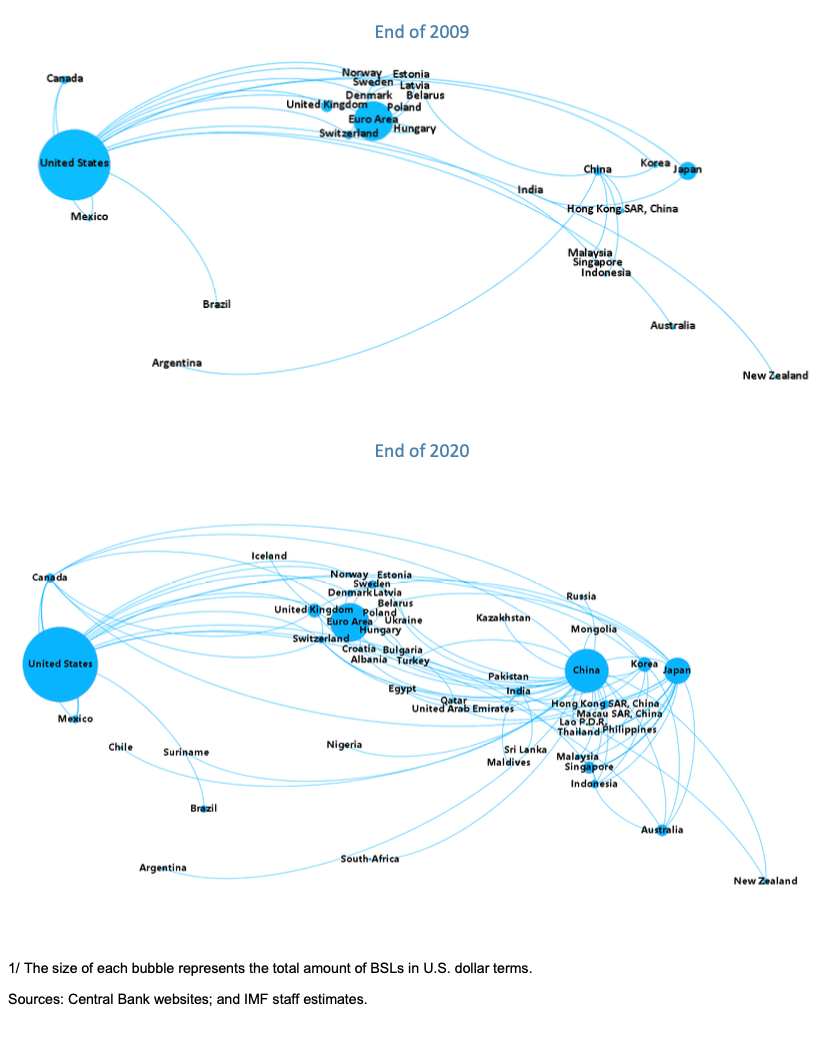

The Fed: international lender of last resort

Even more importantly, dollar hegemony exists because, for decades, the United States has been the only country able and willing to play the role of the international lender of last resort (ILOLR), providing liquidity to international markets and emergency dollar-denominated credit (“swap lines”) to other major central banks in times of major global financial crises. Figure 4 illustrates the Federal Reserve’s leading role—in conjunction with the International Monetary Fund and its country-specific lending programs—in performing this key function in the global economy. Historical experience over the last two hundred years reveals that a dominant reserve currency is closely linked to which governments and central banks are able and willing to perform the ILOLR function in the world economy, either bilaterally, through central bank cooperation, or through the funding of multilateral financial institutions such as the International Monetary Fund (IMF).

FIGURE 4

Here, again, we see that the US and the dollar play a dominant role unlike any other country or currency. The Federal Reserve’s role in providing credit and dollar liquidity to governments and banks in the world economy is unparalleled and has only deepened in response to the economic crises of the past fifteen years. Aside from the Fed, only the European Central Bank, Bank of Japan, and People’s Bank of China play even subordinate roles as providers of swap lines to other central banks, and the scope and scale of their operations pales in comparison to those of the Fed. In large part this is a chicken-or-egg issue: the US and the Fed do this because the world economy currently runs on dollars. But the direction of causality runs both ways: the demand for dollars, across all the dimensions of the international financial system remains precisely because the US is willing to backstop the global economy and provide dollars to keep it running in hard times. Until and unless the EU, China, Japan, or anyone else is willing to step in and play this role as ILOLR, none of the other global reserve currencies are going to replace the dollar at the pinnacle of the international monetary system.

In sum, when one looks at the full set of factors determining global reserve currency status, it is abundantly clear—contra the conventional wisdom in popular debates—that the dollar’s dominance has not declined in any meaningful way over the last two decades. Instead, dollar hegemony is now stronger than ever and its end is not even remotely visible on the horizon. This is not to deny that the RMB is slowly but surely starting to play a larger role in the international monetary system, or that the euro also plays a central role as the world’s second-most-important reserve currency. But neither modest shifts away from the dollar, by a small number of authoritarian countries, nor modest increases in the international role of the RMB and other secondary reserve currencies, pose threats to dollar hegemony. They don’t even signal that any other currency is rising to become a serious challenger to the euro’s role as the second most important global reserve currency.

There is no alternative

The case for dollar hegemony rests not only on its dominant role across all dimensions of global finance but also on the weaknesses of each of the potential challengers. The euro—the number two international currency by a wide margin—is a currency without a government. The EU is the world’s largest economy, but the Eurozone is neither a fiscal nor a political union, and this makes it difficult to persuade others that they can really rely on the euro in hard times. By design, the euro was set up to minimize its role as a safe haven during crises. The Eurozone’s “no bailout clause” guarantees limited transfers from surplus to deficit countries with the monetary union during times of stress. This serves the internal political purposes of the Eurozone’s most powerful countries (most of all, Germany), but it does not serve the external purpose of making the euro a viable option as the dominant global reserve currency. Indeed, the Eurozone now stands on the brink of a second Lost Decade and still has not resolved any of the central problems from the Eurozone crisis of the last decade. Until the Eurozone and its member states finally resolve these structural problems within the monetary union, the euro will remain a distant second to the dollar at the global level.

Likewise, while China’s RMB is slowly beginning to play a larger role in global finance, it is not remotely close to rivaling the euro or Japanese yen, let alone to challenging the dollar’s monetary hegemony. China lacks deep and liquid private financial markets like those in the US and does not allow free flows of capital. Moreover, Xi Jinping’s government has shown no sign that it will accept the political economy trade-offs necessary for the RMB to begin playing a leading role in the international monetary system. Moreover, as an authoritarian regime, China lacks the credibility and transparency necessary to play the role of international lender of last resort. The day may come when the RMB challenges dollar hegemony—or at least becomes a major player as one of a Big Three of global reserve currencies—but that remains many years, if not decades, away.

Finally, despite the evangelism of Silicon Valley and Wall Street aficionados, cryptocurrencies such as Bitcoin perform none of the three functions of money (a medium of exchange, unit of account, and store of value) at either the national or international level. Instead, they are speculative assets, without the political backing or foundations necessary to become reserve currencies, especially during episodes of financial instability. The world economy and international system, as currently structured, simply cannot function with a monetary standard that is not backed by sovereign political power and that cannot be rapidly increased in supply to provide global liquidity in times of financial crises. Moreover, since essentially all so-called stable coins are pegged to the US dollar, any future increase in the reserve role of cryptocurrency assets would likely reinforce, rather than undermine, the dollar’s dominance.

The world economy and international system, as currently structured, simply cannot function with a monetary standard that is not backed by sovereign political power and that cannot be rapidly increased in supply to provide global liquidity in times of financial crises.

Put simply, there is no alternative to the dollar now and there is unlikely to be one in the years to come. None of its supposed competitors are remotely close to meeting the criteria necessary to replace the dollar as the dominant global reserve currency. Despite America’s obvious political problems, which have raised uncertainty about US political and economic hegemony— most especially the increasing extremism of the Republican Party and its willingness to engage in high-stakes antics such as debt ceiling brinksmanship and President Trump’s threatening to withdraw from NATO —the dollar remains unchallenged as the centerpiece of the international monetary system.

Economic and political implications of dollar dominance

The implications of the dollar’s continued dominance are conspicuously missing from current debates about the future of American hegemony and economic policy. Indeed, on the most central issues surrounding US economic and foreign policy, discussion of dollar hegemony and America’s overwhelming and persistent financial power are all but absent from the conversation.

First, consider what dollar hegemony means for US debt and fiscal policy. For years, long before the spring 2023 debt-ceiling crisis, political and policy debates about US debt have all but ignored the unprecedented degree of fiscal autonomy that issuing the world’s dominant reserve currency conveys on the US. Given global demand for dollars (and dollar-denominated assets, including US Treasury bills), the US government can sustain higher levels of debt and deficits than any other country in the world. Yet, time and again, politicians, journalists, and even many prominent economists portray the US as a cash-strapped household or a smaller, less financially important country—such as Greece or Argentina—that faces hard fiscal constraints and persistent debt sustainability problems. Such countries often face “sudden stop” financial crises or—because they borrow in foreign currency or have long records of defaulting on their debts—severe problems of currency mismatch and very high borrowing costs. The reality is that every country that issues a global reserve currency can borrow at the world’s lowest interest rates and sustain levels of debt and deficits far in excess of other countries. This is true of Japan, Canada, Switzerland, Australia, the Eurozone, and even the post-Brexit United Kingdom. Yet in today’s era of unprecedented global financial flows, this is all the more true of the US, given the dollar’s overwhelming dominance and the sustained demand for dollar-denominated assets it entails.

This does not mean, of course, that we should abandon responsible fiscal policy or avoid discussions about the tradeoffs involved in fiscal policy choices. Reasonable people can and will disagree about how, whether, and when the US should invest more in infrastructure, scientific research, higher education, health care, military equipment, or anti-poverty programs, and whether we should finance these investments through taxes, debt, or some combination of the two. We should certainly have these discussions. But we need to do so in the context of recognizing the essentially nonexistent fiscal constraints the US faces today, given dollar hegemony and America’s unparalleled, persistent dominance in the global financial system. Those arguing that the US—or, for that matter, Germany or the Eurozone as a whole—faces urgent needs or strong market pressures to balance budgets or reduce debt-to-GDP levels are expressing entirely political preferences, not hard economic realities.

Those arguing that the US—or, for that matter, Germany or the Eurozone as a whole—faces urgent needs or strong market pressures to balance budgets or reduce debt-to-GDP levels are expressing entirely political preferences, not hard economic realities.

Second, discussions of dollar hegemony and its implications are conspicuously absent from current policy debates in Washington, New York, Brussels, and elsewhere about the rise of China and the future of American hegemony and transatlantic relations. American public debate has become obsessed with the US–China rivalry, and the belief that American hegemony is inevitably declining in the face of an inexorably rising China has—much like the inevitable decline of dollar dominance—rapidly become the conventional wisdom. Those advancing this view frequently cite China’s GD P, its size in international trade, its growing military expenditures and technological advances, and other factors to bolster the narrative of hegemonic rivalry and American decline. Missing from these discussions, however, is a serious reckoning with the dollar’s persistent and overwhelming dominance, let alone the broader gap in global financial power between the US and China along each of the dimensions discussed above. If we are going to take seriously the US–China rivalry and have thoughtful discussions about changes in relative power in the international system, we must address this glaring omission. As with discussions about US economic policy and debt sustainability, debates about the future of American hegemony and great power competition need to be grounded in a more accurate assessment of relative power.

Reports of the dollar’s untimely demise—or even its decline—are not new, and they remain greatly exaggerated. Recognizing the gap between rhetoric and reality is crucial, not only for understanding the trajectory of the global economy and US economic policy, but also for understanding the nature of power in the international system and the future of hegemonic rivalry between the US and China. If we are to have thoughtful, productive debates about these topics, we must start with an accurate view of the world economy and international power structures as they are, not only as we believe them to be. And on the dimension of international money and finance, the US and the dollar continue to enjoy unchallenged dominance and will do so for many years, if not many decades, to come.

This article first appeared in the Berlin Journal 37 (2023-24).