Bigger Profits, Slower Growth

Extracting value from the information economy

By Herman Mark Schwartz

Ethnonationalist, anti-immigrant, anti-system parties emerged in wealthy OECD countries three times over the past century—the 1920s, 1960s, and again today. Each of these episodes has complex causes, but the deepest and most common are related to status anxiety: fears of diminished social, household, and racial authority on the part of core male ethnonational populations in European and North American countries. The crumbling hierarchies of race, gender, and ethnicity in each of these episodes triggered backlashes against immigrants, minorities, and women.

But these three episodes of populist uproar did not gain equal traction. Why? For an economist, the answer lies not just with social dynamics, but rather with the economic factors driving them: weakening employment and wage prospects.

Today, as in the 1920s, wage growth has been muted in many countries, with specific segments of the male population experiencing falling wages. And even where wages have risen, the gap between the top, the bottom, and the middle has widened. Moreover, growing income inequality has a distinctly regional flavor, with a handful of cities or regions experiencing robust growth and others stagnating. By contrast, the 1960s had robust and relatively equally distributed growth that countered—though certainly did not eliminate—other changes in status. Incomes for the male ethnonational core population were rising so quickly in the 1960s that other challenges to identity receded in importance. Older men could see a clear path forward for their sons and the sons of other men. Lurking behind much political sloganeering today is an aspiration that harkens back to that optimistic time: How can we get back to more rapid and egalitarian growth?

In the area of international economics, addressing slow growth and inequality requires a correct analysis of those problems’ sources. Contemporary debates about slow growth—also known as “secular stagnation”—pit supply-side arguments about technological exhaustion against demand-side arguments about insufficient income for the poorer 90 percent of the population. The American economist Robert Gordon, for example, recently argued that the US economy has exhausted almost all sources of productivity growth that powered the expansion of the US economy in the first half of the twentieth century and then spread to the rest of the world in the second. In his view, flush toilets mattered much more than flashy cell phones ever will. And since there’s nothing worth investing in that will yield huge productivity improvements, slow growth is the new normal. This is a supply-side argument.

But there’s a problem with this, as a tour of any major research university or the archives of “Technology Surveys” in the Economist will reveal: backlogs of significant innovations are waiting for commercialization. So, why haven’t those innovations flowed into the economy? One reason is that it takes some time for innovations to radically change an economy. The full benefits of the electrification of production were not felt for roughly fifty years, and they required substantial physical and managerial reorganization of production processes. Another reason is the dearth of incentives for firms to invest in new technologies. The continuous-flow assembly line, which required electrification, did not become a pervasive production-format until there was enough demand in the economy to justify investing in it. These reasons point away from the supply-side of the economy and towards the demand- or income-side.

The full benefits of the electrification of production were not felt for roughly fifty years, and they required substantial physical and managerial reorganization of production processes.

Demand-side arguments, largely associated with former US Treasury Secretary Larry Summers, start from a simple point: the marginal propensity to consume decreases as household income rises. In other words, the percentage of total income a household spends falls as its income rises. And because the rich have a lower marginal propensity to consume, rising income inequality leads to less overall consumption. And not just in America: income inequality has been rising in all the rich OECD countries, albeit at different rates. Even Sweden and Germany have pre-tax and transfer-market incomes that resemble those of the United States, which means that robust welfare states can mitigate but not eliminate this market-driven behavior.

Like the supply-side arguments, demand-side arguments are also correct but incomplete—in two ways: First, if the top 10 percent or 1 percent of income earners are receiving an increasingly larger share of national income, that would explain why consumption might not be growing so quickly, since fewer people with more money are buying less. But if the wealthy are not spending their money buying things, they must be saving it. Yet these increased savings are not translating into investment into the creation of new productive capacity, thus accelerating GDP growth. Instead, their capital is flowing into the GDP-neutral purchase of existing assets, e.g. stocks and bonds.

Second—and the focus of the rest of this essay—is that arguments about income inequality don’t explain why it has been rising. They look at households but ignore the fact that households get their income from somewhere, and that somewhere is, generally, firms. Firms do the bulk of productive investment. They do so by using current profits, or by pledging to repay borrowed money out of future profits. Firms are the primary source of income, and the primary generators of net new productive investment. So, in order to understand firms’ role in the creation of broader inequality, we need to look at their recent tendencies toward sluggish investment and the limits set on government spending incurred by tax avoidance.

One way corporate inequality can be seen is via the measurement of levels of inequality among firms’ profits. This is evidenced by something called the Gini coefficient (named after the early twentieth-century Italian statistician Corrado Gini). This standard measure ranges from 0 (perfect equality) to 1 (one firm or person gathers all income). Sweden has a household income Gini of 0.28; Germany, of 0.29; the United States, 0.39; South Africa, 0.62. The Gini for cumulative profits of the 2000 largest firms in the global economy over the past 13 years is 0.69. Because these firms collect roughly one-third of all profits for the 28,000 global firms with annual revenues over $200 million, the true Gini is likely even greater. This evidences a profit inequality among firms even higher than that of households or individuals. But this was not always the case. Though the Gini for the 1,361 profitable American firms in 1960 was similar to today, those firms employed almost a third more US workers proportionately. This raises a big question: What happened to firms such that this massive inequality of profitability now translates into massive income inequality?

The answer, quite simply, is that changes in corporate strategy and structure over the past thirty years have increased inequality in the distribution of profits among and within firms, and thus in income for households. While this is a worldwide phenomenon, it is an uneven one, because these changes in corporate strategy and structure have not occurred uniformly everywhere.

Changes in corporate strategy and structure over the past thirty years have increased inequality in the distribution of profits among and within firms, and thus in income for households.

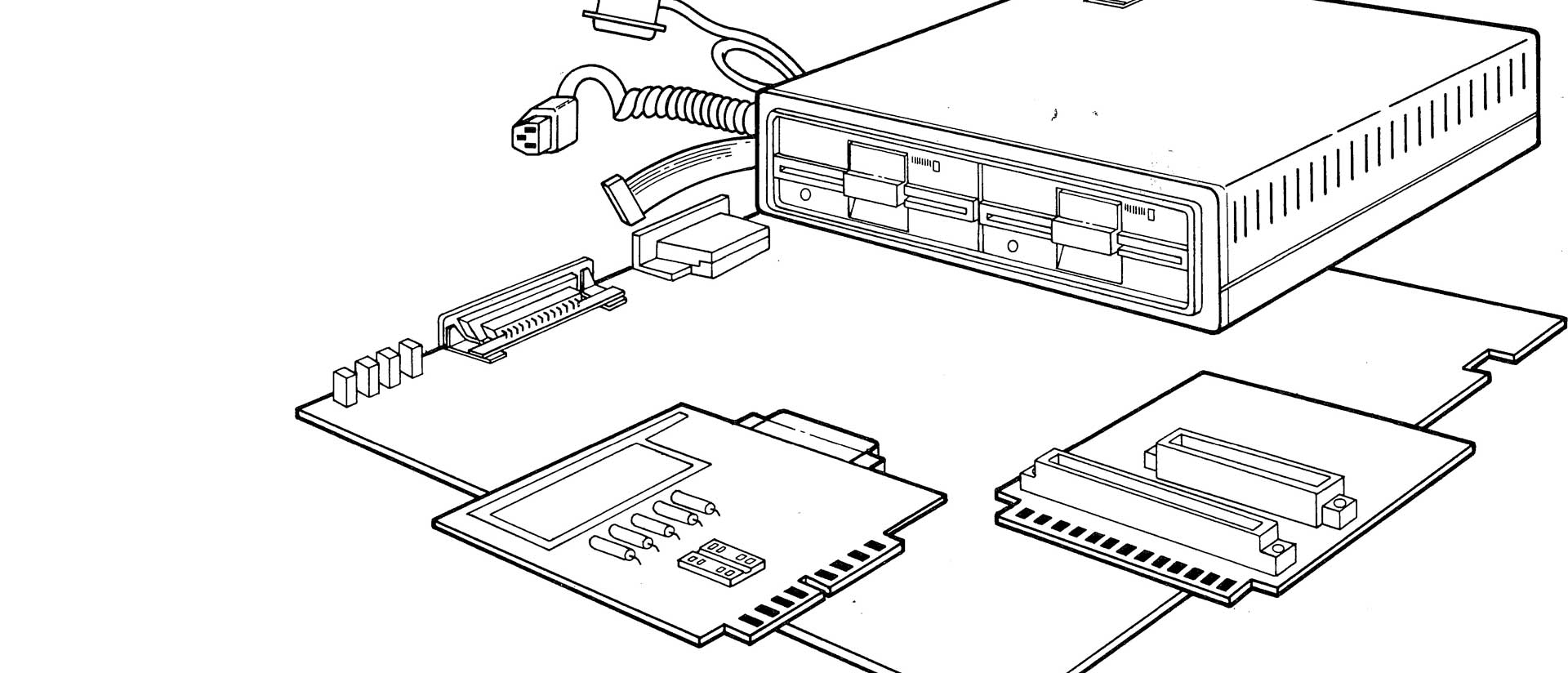

Still, in the old economy, from roughly 1950 to 1985, profits flowed from control over physical capital deployed in vertically integrated (i.e. everything inside) firms. Mid-twentieth century firms’ profitability depended on their control over these large fixed physical-capital investments, and the efficient management of that physical capital. The biggest and most profitable firms did most of their production in-house, and their employee base incorporated a huge range of ancillary services supporting production. Think of General Electric or General Motors or Siemens or Volkswagen in the 1960s. GM employed 600,000 people in 1960, and it did, inter alia, its own accounting, cleaning, and catering. (The nearest equivalent today would be the diversified industrial giant Samsung.) In the 1960s, 80 percent of the stock market capitalization of the US S&P 500 was tangible physical assets such as plants and equipment, and big firms like GM and GE captured the bulk of profits.

By contrast, today’s “information economy” profits are earned from controlling intellectual property rights (IPRs)—patents, copyrights, brands, trademarks, licensing—deployed in vertically disintegrated production chains. IPRs create monopolies, so firms that successfully control IPRs in a production chain capture the bulk of profits. This shift in strategy and industrial structure drives rising inequality among firms and individuals because IPR firms do not distribute their monopoly rents over a large workforce. They also don’t need to make large investments as compared to the old economy firms. The firms with the biggest market capitalization and profitability are those controlling the most valuable IPR portfolios.

Today’s “information economy” profits are earned from controlling intellectual property rights (IPRs)—patents, copyrights, brands, trademarks, licensing—deployed in vertically disintegrated production chains. IPRs create monopolies, so firms that successfully control IPRs in a production chain capture the bulk of profits.

In a significant change in industrial organization, information-economy firms largely subcontract everything not related to the direct production of their IPRs, including the physical production of goods, shrinking their employee base to the absolute minimum. Apple, for example, employs 90,000 people, but 60,000 of them are contract workers in its retail stores. Apple subcontracts virtually all of its physical production to firms like Foxconn that employ cheaper Chinese labor. By 2015, 83 percent of the market capitalization of the S&P 500 was intangible assets, and Apple collected 3 percent of the cumulative profits of the 600 largest US firms from 2006-2016; Microsoft collected 2.2 percent. These are historically large percentages, and they drive the very high Gini coefficient for global profits.

The next piece of the puzzle: profit inequality interacts with changing corporate structure to produce income inequality. Integrated firms once internalized production chains; most of the work force involved in production was legally inside the firm as well as physically inside the factory or other corporate buildings. Cleaners, accountants, engineers, designers, managers, and production workers all worked side-by-side and were legally employees of that firm. A firm like GM generated 70 percent of its final value internally. Now, production chains are split among global and domestic supply chains that involve different kinds of firms. Indeed, workers from different firms often see labor side-by-side in the same factory, with contract production workers, subcontracted cleaners, external logistics firm-workers, and the factory owner’s employees all rubbing shoulders. In the old factory, unions and the solidarity created by having the same employer tended to redistribute monopoly and oligopoly rents towards workers, and among workers from higher skilled to lower skilled workers. Today, weaker unions and the fragmentation of workers over multiple employers limit this kind of intra-firm redistribution.

If most firms were the same, this might not matter. But firms have also fragmented into three different general types. Most value-chains now form a “wedding cake” structure, composed of human capital-intensive, small labor-headcount IPR firms; physical capital-intensive firms producing components or owning real estate; and labor-intensive, high-headcount firms that do simple assembly or service tasks. This produces an upside-down pyramid of profits and a right-side-up pyramid of workers. The monopoly position of IPR-owning firms concentrates profits into the hands of those firms. The barrier-to-entry created by big physical-capital investments gives firms in the middle more moderate profits. And firms at the bottom have neither a monopoly nor a barrier-to-entry, and so typically make the smallest profits.

This explains the next step: higher-profit firms pay higher wages, so increased profit-inequality drives increased wage and income inequality outside the firm. This, in turn, underlies the limits on consumption growth, because high-profit firms employ far fewer workers in aggregate than do the other firms. Microsoft’s 100,000 employees generated cumulative profits during 2005-2016 that were roughly equal to the combined one million employees at Volkswagen-Audi, BMW, and Daimler. Foxconn’s one million employees, who assemble much of the world’s electronic equipment, generated profits equaling only one-fifth of Microsoft’s.

Profit inequality also limits investment growth. Profit-rich IPR firms don’t need new investment to expand production (in the extreme case, a new MP3 file or copy of iOS has zero investment or production costs). Instead, they hire coders or designers. Firms that do engage in physical production have neither the will nor ability to generate much net new investment. They lack IPR firms’ outsized profits; they find it safer to meet slow growth in demand through normal productivity growth. Indeed, Apple had to give Corning Glass $200 million to induce them to build a new factory for the next generation of Gorilla Glass cell phone screens.

The conclusion: rising income inequality, and, in turn, secular stagnation, flows from the combination of the change in firms’ profit strategies (where profit comes from) and from changes in industrial organization (how profit gets distributed).

Identifying the corporate roots of inequality and stagnation makes it possible to identify better, attainable solutions to those problems and thus to address the economic roots of the current populist backlash they have helped to induce. The solutions fall into four groups of actions that should be undertaken by national legislatures, especially the United States Congress. They need to:

1) Address the root causes of profit inequality by strengthening national and global level anti-trust law. In parallel, they also need to reform IPR law, since patent and copyright protection is needed to induce innovation. Currently patents are too easy to receive, and they constitute an overly strong barrier to entry. Moreover, copyright lasts well beyond the lifespan of any author, and currently rewards corporations and heirs.

2) Strengthen workers’ bargaining position. Here, the United States in particular needs a more robust welfare state that guarantees access to healthcare and provides a minimum income. This could be offered in exchange for twenty hours of work in the market or in social services. In the private labor market, brand owners should have legal responsibility for labor practices and wages in their franchisees. A higher minimum wage would also boost purchasing power.

3) Fix taxation so that corporate and individual tax-avoidance is more difficult to accomplish. The OECD has already started on this road, with its Base Erosion and Profit Shifting initiative, which monitors profit-shifting by firms with strong IPR portfolios.

4) Pursue international trade agreements that raise labor standards and work conditions in low-wage competitors. This would broaden markets for high-quality products from advanced economies and help workers in poorer ones.

All of these initiatives would induce more labor-saving innovation and investment, which would, in turn, drive growth and validate higher wages across the wealthy OECD economies.

But the economy, of course, is easier to fix than people’s attitudes and identities. Changing those, as Max Weber put it, is a process of strong and slow boring of hard boards. Though attitudes about race, gender, and sexual identity have shifted significantly over the past half-century, the explosion of overt misogyny and racism on social media and in the political sphere reveal many hard mental boards that are the basis for planks in anti-system parties. It will probably take a generational change to shrink the residual population holding those attitudes. Yet the political crisis posed by anti-system parties is already acute. Considering the absence of sustained, successful anti-system parties in the 1960s can point us towards economic policy as a better short-term response to anti-system parties. These kinds of economic-policy changes—and not mere anti-populist rhetoric—are what will lead to immediate ameliorating effects.

Herman Mark Schwartz is a professor of politics at the University of Virginia and an economic historian who studies how state and market power are constituted and interact.