Capital Returns

Income concentration and technological change in Germany, 1871-2014

by Charlotte Bartels

Is technological progress boosting top incomes, or is it benefitting broad parts of the wage-earning population? The dramatic increase of the top percentile’s income share in the United States has revived interest in the evolution of top incomes. Beginning with the seminal contributions of Thomas Piketty (2001, 2014), a succession of studies estimated top-income shares over the twentieth century for countries around the world, looking at the data of 100 years. It was at the beginning of the twentieth century that modern income-tax systems were introduced in many countries, thus making data on top incomes available.

By expanding a focus on Germany for a period of 140 years, however, we are able to investigate more finely the relationship between technological progress and top-incomes, to see if this relationship operates uniformly across various periods. Using German income-tax statistics and the Pareto interpolation technique (a method of estimating distribution income in a given population), one may estimate the share of total gross market income accruing to top groups, including the top 1%. Moreover, German data from this period provide a unique possibility to study the evolution and drivers of income concentration at the top since the period of industrialization, revealing the long-run evolution and macroeconomic significance of capital and technological change. (Modern income taxation was introduced across German states already during the nineteenth century.)

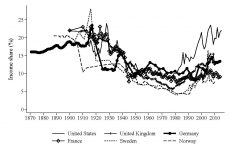

Comparing income concentration in Germany to other countries reveals a strikingly stable income concentration in Germany over the twentieth century. In fact, income concentration today in Germany is not substantially different than it was in 1871, when Germany achieved political unification. The income share of the top 10% was roughly 40% in 1871, the same as it was in 2014. The income concentration at the very top (top 1% and top 0.1%), however, appears to be lower now than it was in 1871. Still, income inequality in Germany since 1871 has experienced violent swings. During industrialization (the first period), it was accompanied by a steady increase in the top percentile’s income share, which lasted up to the start of WWI. Top incomes collapsed during the hyperinflation years of the 1920s (the second period), but increased again rapidly throughout the Nazi period beginning in the 1930s (the third period). In the fourth period, after WWII, top-income shares returned to the levels of the 1920s. During the fifth period, after reunification, Germany caught up to the United Kingdom’s and the United States’ elevated levels of inequality.

The income share of the top 10% was roughly 40% in 1871, the same as it was in 2014.

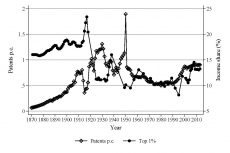

Figure 1 (below) shows the evolution of the top percentile’s income share in Germany in comparison to the trends observed in France, Sweden, the United Kingdom, and the United States. Although the German top percentile also experienced a U-shape pattern over the twentieth century, the U-shape is rather flat and interrupted by the skyrocketing shares before and during the two world wars. The top percentile’s share in Germany was comparably low in the first half of the twentieth century. As in Sweden, the decline in income concentration in Germany occurred toward the end of WWI and in the 1920s. In France, the United Kingdom, and the United States, by contrast, the most pronounced drop occurred during WWII. In the postwar period, income concentration in Germany was relatively high. This may come as a surprise, since this phase is viewed internationally as one of low inequality. One might speculate that the compressed wage distribution—well documented in a variety of survey and administrative data sources from this period—might have led to this view. But neglecting the analysis of income-tax data in the postwar period would leave the picture incomplete: the United States surpassed Germany in the 1980s. Since the mid-1990s, Germany has been on a path of increasing income-concentration, catching up with the elevated income concentration levels in the United States.

Figure 1: Germany in international comparison – top 1%

Source: WID.world and Bartels (2019).

The bottom 50 % lost out against the upper half of the distribution over the postwar period, as shown in Figure 2, below. In the years of the German Wirtschaftswunder (economic miracle), strong labor-demand and high GDP growth rates coincided with powerful unions, low unemployment, and a relatively compressed wage distribution. The bottom 50% received a third of total income. With the oil crises and the onset of mass unemployment, the share of the bottom 50% collapsed to less than a quarter. In the 1970s, the share of employees in the service sector surpassed the share employed in the industrial sector. The decline of the bottom half is mirrored by an increase of the middle 40%, whose income share increased to more than 40% of total income since the 1970s. The middle 40%’s share has remained relatively stable ever since.

With the growth of the low-income sector at the end of the 1990s, the share of the bottom half declined significantly, from 22% in 2001 to 15% in 2014. The recent decline of the bottom half is mirrored by an increase of the top decile’s income share. In 2014, the bottom half of the population had a 15% share of total income, while the top decile’s share was 41%. The top decile’s income share in Germany today has again reached the high levels of the industrialization period.

Figure 2: Germany, 1961-2014 – Bottom 50%, middle 40% and top 10%

Source: Bartels (2019)

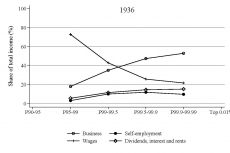

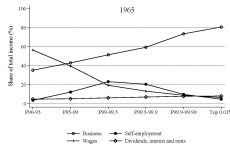

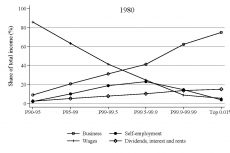

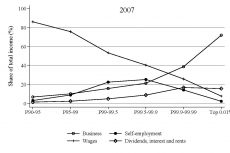

The changing composition of top incomes is a first step toward understanding up- and downswings in income concentration over time. Figure 3 displays the composition of top incomes within fractiles of the top decile moving toward the very top of the income distribution. Three basic conclusions apply to the four years presented for illustration: First, business income from unincorporated firms is always the most important income source of top income earners in the top percentile and among those at the top of the top. In contrast, incomes of the bottom 9% of the top decile are mostly composed of wages. Second, capital income—dividends, interest income, and rents—is of minor importance in Germany compared to other countries such as France or the United States. Even for the top 0.01 percent, capital income never comprises more than 20 percent of total income. This is not surprising, as most German firms are unincorporated, often held by a few family members, and generate business income.

Even for the top 0.01 percent, capital income never comprises more than 20 percent of total income. This is not surprising, as most German firms are unincorporated, often held by a few family members, and generate business income.

Fluctuations in business incomes are a major force behind the dynamics of top-income shares in Germany. Peaks in the top 0.1% income share are associated with periods of high business incomes. This pattern is even more pronounced for the top 0.01%, which generated 80% of their income from business in 1961 and 1965 and roughly 70 percent in 1989, 1998, and 2007. The increase in income concentration during the period of rearmament leading up to WWII can be attributed to a rise in business incomes at the top. The fall in income concentration in the late 1960s and after reunification, in the 1990s, also coincides with falling business incomes at the top.

Top managers and the highly qualified self-employed increasingly entered top income groups beginning in the 1980s. Whereas wages were less than a tenth of the top 0.1%’s income in the 1960s, the wage share increased to almost 30% in the first decade of the 2000s. The surge of top-wage incomes in the second half of the twentieth century was a common phenomenon also found in Italy, the Netherlands, Spain, and the United States. This was in stark contrast to the rising importance of capital income at the top in Finland, Sweden, and the United Kingdom (Atkinson, Piketty, and Saez 2011). Increasing wage inequality at the top in Germany since the 1980s is also documented by Dustmann, Ludsteck, and Schönberg, 2009). However, wages still comprised less than a tenth of the top 0.01% income in the 2000s. This stands in contrast to findings for the United States, where the working rich gradually replaced rentiers over the course of the twentieth century, with the top 0.01% generating half of their income from wages by the 2000s. The share of capital income in total income has also increased since the 2000s (Piketty, Saez, and Zucman 2018).

Figure 3: Composition of top incomes

Source: Bartels (2019)

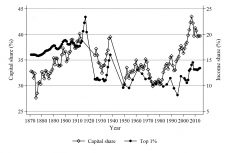

Focusing on Germany for a period of 140 years enables us to investigate whether potential drivers of top-income shares operate uniformly across periods. I argue in a study published last year in the Journal of Economic History that relationships are likely to change over time. In that study, I investigate the extent to which the functional income distribution, economic growth, technological change, globalization, the power of trade unions, and redistribution through progressive income taxation are associated with changes in top-income shares, all of which are often suggested and investigated confounders of inequality. Here, I summarize the results on the capital share and technological change. Figure 4 contrasts the evolution of the technological change (left-hand panel) and capital share (right-hand panel) with the top 1% income share.

Figure 4: Technological change and capital share

Source: Capital share from Bengtsson/Waldenström (2018), patents from Madsen (2007), top 1% share from Bartels (2019)

Theoretically, a rising capital share increases inequality, if the correlation between wage and capital income is sufficiently low and if the inequality of capital income is sufficiently high. My results show that the capital share in national income is strongly positively correlated with the top percentile’s income share throughout all periods. The correlation is higher than 0.8 in all but the postwar period, 1949–1989. Bengtsson and Waldenström (2018) document the strong statistical relationship between capital share and top-income shares for a wide range of countries. The recent increase of the capital share—which implies a decrease of the wage share—is often connected to the decline of union power. De-unionization is identified by Biewen and Seckler (2019) as the dominating effect for rising wage inequality in Germany from 1995 to 2010.

The recent increase of the capital share—which implies a decrease of the wage share—is often connected to the decline of union power.

Technological progress may favor wage inequality as higher heterogeneity of tasks increases demand for high-skilled labor (skill-biased technological change) (Acemoglu and Autor 2011). Indeed, technological change has been identified as the main cause for increasing wage-inequality at the top of the distribution in the 1980s (Dustmann, Ludsteck, and Schönberg, 2009). (I measure technological progress by the number of patent applications per capita for which long-run time series are available from Madsen (2007)). Technological progress is associated with lower income-concentration in the middle of the twentieth century, but is also associated with higher income concentration both in the period of industrialization and in recent decades. This corroborates findings that recent technological change drives inequality, particularly in the upper part of the income distribution (IMF 2007; OECD 2011).

All in all, my study suggests that periods of rapid technological change tend to enrich top income earners, who are owners of capital. The capital share in national income is a strong predictor of high top-income shares. If the relations observed for the past 140 years hold, a sustained increase of the capital share will favor greater income concentration in the future.

References

Acemoglu, Daron, and David Autor. “Skills, Tasks and Technologies: Implications for Employment and Earnings,” In Handbook of Labor Economics, Volume 4b, edited by David Card, and Orley Ashenfelter, 1043–171. Amsterdam: Elsevier-North, 2011.

Bartels, Charlotte: “Top incomes in Germany, 1871-2014,” Journal of Economic History 79, no. 3 (2019): 669-707.

Bengtsson, Erik, and Daniel Waldenström. “Capital Shares and Income Inequality: Evidence from the Long Run,” Journal of Economic History 78, no. 3 (2018): 712–43.

Biewen, Martin, and Matthias Seckler: “Unions, Internationalization, Tasks, Firms, and Worker Characteristics: A Detailed Decomposition Analysis of Rising Wage Inequality in Germany,” Journal of Economic Inequality 17 (2019): 461–498.

Dustmann, Christian, Johannes Ludsteck, and Uta Schönberg. “Revisiting the German Wage Structure,” Quarterly Journal of Economics 124, no. 2 (2009): 843–81.

IMF. “Globalization and Inequality,” In World Economic Outlook 2007, 31–65. Washington, DC: International Monetary Fund, 2007.

Madsen, Jakob B. “Technology Spillover through Trade and TFP Convergence: 135 Years of Evidence for the OECD Countries,” Journal of International Economics 72, no. 2 (2007): 464–80.

OECD. Divided We Stand: Why Inequality Keeps Rising? Paris, France: OECD Publishing, 2011.

Piketty, Thomas. Les hauts revenus en France au XXe siècle: Inégalités et redistributions, 1901–1998. Paris, France: Grasset, 2001.

———. Capital in the 21st Century. Cambridge, MA: Harvard University Press, 2014.

Piketty, Thomas, Emmanuel Saez, and Gabriel Zucman. “Distributional National Accounts: Methods and Estimates for the United States,” Quarterly Journal of Economics 133, no. 2 (2018): 553–609

Charlotte Bartels is a post-doctoral researcher at the German Institute for Economic Research (DIW).